Human rights

Human rights grievance complaints to financial institutions over Santos’ Barossa gas project

On 4 April 2023, the following Traditional Owners, Elders and clan members filed human rights grievances against financial institutions supporting the Barossa gas project located in waters off northern Australia:

PIRRAWAYINGI (MARIUS) PURUNTATAMERI

Munupi Senior Man, Mayor of the Tiwi Islands, Traditional Owner and senior Elder of the Munupi clan of the Tiwi Islands

PAULINA JEDDA PURUNTATAMERI

Tiwi Woman from the Munupi clan, a freshwater woman, and an Elder in her community

CAROL MARIA PURUNTATAMERI

Munupi Senior Woman, Traditional Owner and Elder of the Munupi clan of the Tiwi Islands

DENNIS MURPHY TIPAKALIPPA

Munupi Senior Law Man, Traditional Owner and leader of the Munupi clan of the Tiwi Islands

THERESE WOKAI BOURKE

Regional Councillor, leader of the Malawu clan of the Tiwi Islands

SIMON MUNKARA

Member of the Jikilaruwu clan of the Tiwi Islands

TIBBY QUALL

Larrakia Elder and Traditional Owner

Human rights complaints, or grievances, were sent to the following banks for an apparent failure to undertake adequate human rights due diligence for the US$1 billion loan in addition to breaches of policy and international human rights standards, including the failure to obtain free, prior and informed consent:

ANZ

(Australia)

CBA

(Australia)

Westpac

(Australia)

NAB

(Australia)

ING

(Netherlands)

DNB Bank

(Norway)

Citigroup

(USA)

Royal Bank of Canada

(Canada)

DBS Bank

(Singapore)

MUFG

(Japan)

SMBC

(Japan)

Mizuho

(Japan)

Additional complaints may be filed for other banks.

Export credit agencies, government owned financial institutions of last resort, from Japan and the Republic of Korea, are set to provide a further US$1 billion of financial support to joint venture partners SK E&S in Korea and JERA in Japan.

The export credit agencies that received complaints were:

KEXIM

(Republic of Korea)

K-SURE

(Republic of Korea)

JBIC

(Japan)

The human rights complaints request each financial institution to exit loans and facilities for the risky Barossa offshore gas project. Responses are sought by 16 May 2023.

A sample grievance to ANZ is here.

Bank Responses to Grievances: Report

12 out of 15 banks and export credit agencies (ECAs) have responded to the Human Rights Grievances filed in April 2023 by Tiwi and Larrakia Elders and Traditional Owners.

In the Grievance, Traditional Owners explained the serious human rights risks of Santos’ Barossa project and the lack of free, prior and informed consent (FPIC). Amongst other requests, the Grievance asked the banks to accept their contribution to the human rights impacts, to publicly apologise to Traditional Owners and to provide the results of any human rights due diligence conducted by the bank. The Grievances also invited the banks to engage in a dialogue with Traditional Owners on Tiwi Country.

Most of the banks and ECAs rejected the requests in the Grievance. See the table below for a summary of their answers, or read the Full Report.

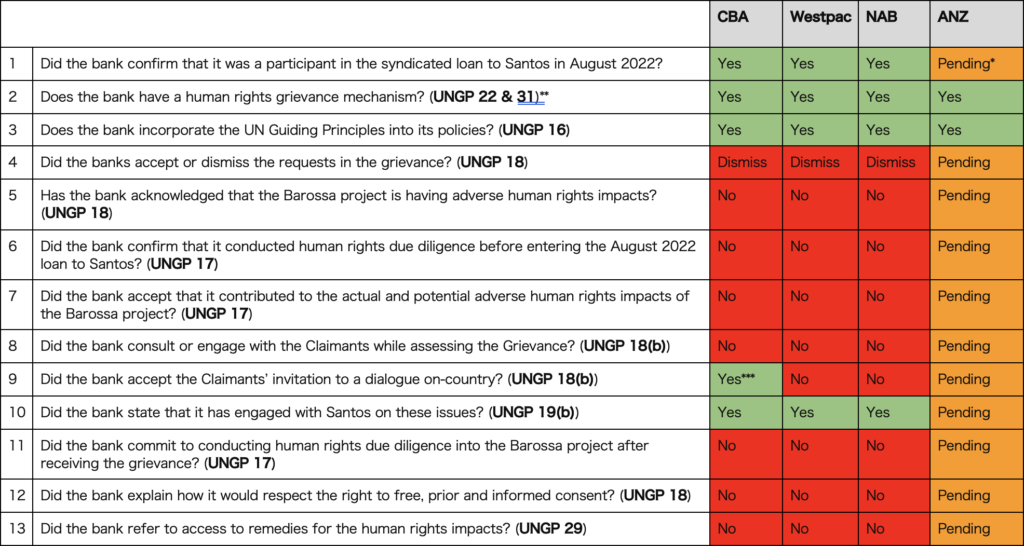

Summary table of Australian banks’ responses

* ANZ is yet to confirm whether it will accept the Grievance as part of its Human Rights Grievance Mechanism. ANZ’s policy states: “The Mechanism can only accept a human rights complaint about a customer where the customer consents to us disclosing the existence of a lending relationship.”# In other words, Santos needs to give ANZ permission to accept the Grievance. ANZ has engaged with representatives for the Claimants to keep them updated about its lack of progress.

**“UNGP” in this table is a reference to the UN Guiding Principles on Business and Human Rights, an internationally accepted set of standards which all four Australian banks have committed to in their policies.

***CBA accepted the invitation to speak with the Claimants after making the decision that it had not contributed to the human rights impacts and after dismissing all the other requests from the Claimants in the Grievance.

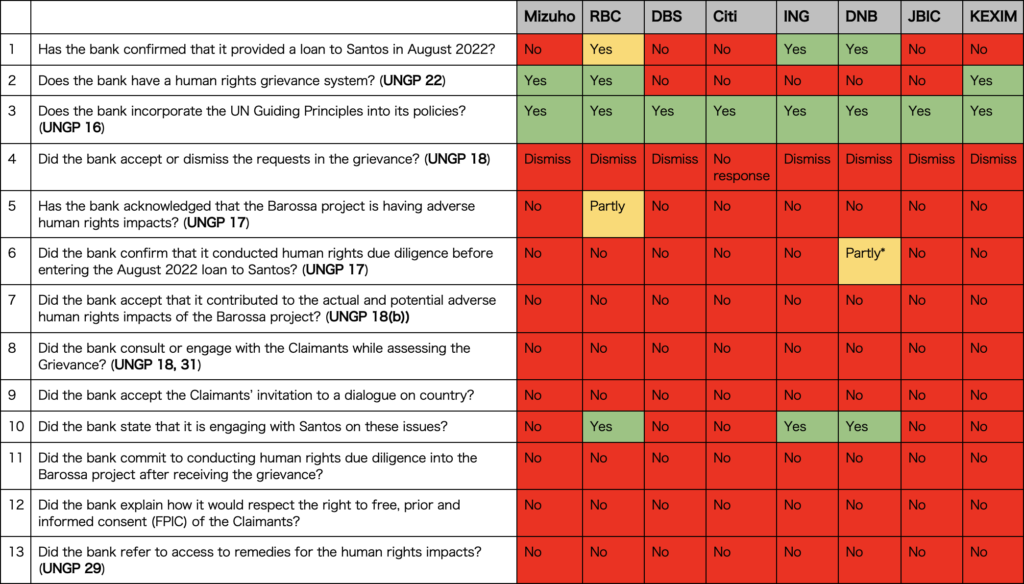

Summary table of International Banks & ECA Responses

*DNB stated that it has “carried out human rights due diligence of Santos Ltd at several stages of the client relationship, and prior to every credit decision.” DNB did not provide any detail regarding the outcome of its human rights due diligence processes.

The following international banks did not acknowledge the Grievance or respond to it:

- Sumitomo Mitsui Banking Corporation

- Korea Trade Insurance Corporation

- Mitsubishi UFJ Financial Group

Notably, all three banks have committed to the UN Guiding Principles on Business and Human Rights.

Human rights complaints to superannuation funds regarding Santos’ gas projects

On 26 April 2023, Tiwi Islander, Larrakia and Gomeroi/Gamilaraay Traditional Owners sent human rights complaints to Australia’s largest superannuation funds regarding their investments in Santos Limited (ASX:STO) and its proposed Barossa and Narrabri gas projects. The correspondence was sent jointly by superannuation fund members who requested information from the funds under section 1017C of the Corporations Act 2001 (Cth) as a result of concerns about the management of each of the funds.

The complaints set out the serious human rights impacts of the Barossa/DLNG projects on the Tiwi and Larrakia people, and the Narrabri project on the Gomeroi/Gamilaraay people. The impacts include serious risks to the spiritual, cultural and economic rights of Traditional Owners and the failure to obtain free, prior and informed consent.

Equity Generation Lawyers, the firm that represents the Traditional Owners and fund members, referred to each fund’s apparent failure to act in accordance with international human rights principles as a result of being unable to ensure that Santos avoids the adverse human rights impacts.

Funds can discharge their obligations in a number of ways. In addition to effective engagement with Santos, international guidance directs funds to collaborate to increase their leverage and engage with governments and regulators to prevent human rights abuses. If leverage fails, funds are to consider divestment. All such actions are understood to be permitted and arguably required by Australian law particularly in circumstances where Santos’ growth strategy has been described by analysts as financially reckless.

The complaints were sent to the trustees of Australia’s largest superannuation funds:

AMP Limited

Australian Retirement Trust

AustralianSuper

Aware Super

Brighter Super (formerly LGIAsuper, includes Energy Super)

BT (formerly BT Financial Group)

Construction and Building Unions Superannuation Fund (Cbus Super)

Colonial First State

Commonwealth Superannuation Corporation

Equipsuper (includes Catholic Super)

Emergency Services & State Super

Government Employees Superannuation Fund

HESTA

Hostplus

MLC Super Fund

OnePath

Retail Employees Superannuation Trust (REST)

State Super

Super SA

UniSuper

The complaints request information about how funds are complying with international human rights standards, the incorporation of human rights risks into their risk management frameworks, and to otherwise justify investments in Santos in the absence of effective fund engagement to prevent impacts.

International human rights principles suggest funds should consult Traditional Owners on the fund’s proposed actions. Fund executives and trustee directors have been invited to discuss the Traditional Owners’ concerns on Tiwi, Larrakia and Gomeroi/Gamilaraay country.

Responses are sought by 26 May 2023.

A sample complaint letter to AustralianSuper is here.

Fund Responses: Report

The responses by superannuation funds to Human Rights Complaints sent in April 2023 by fund members and Tiwi, Gomeroi/Gamilaraay and Larrakia Elders and Traditional Owners have been analysed in a new report by Equity Generation Lawyers.

The Complaint dealt with the serious human rights risks of Santos’ Barossa and Narrabri projects, including the failure by Santos to obtain free, prior and informed consent, or FPIC, from communities.

The funds’ responses were checked against the requirements of the United Nations Guiding Principles on Business and Human Rights, or UNGPs.

Funds can discharge their obligations under the UNGPs in a number of ways. In addition to effective engagement with Santos, international guidance directs funds to collaborate to increase their leverage and engage with governments and regulators to prevent human rights abuses.

Ten funds were open to meeting Traditional Owners to learn more about the impacts.

While some funds said they are engaging with Santos, not a single fund confirmed it would use its leverage to attempt to stop the Barossa and Narrabri projects that lack consent from Tiwi, Larrakia and Gomeroi/Gamilaraay Traditional Owners. None of the funds have standalone human rights policies or human rights due diligence processes.

The funds that did not provide a substantive response were Colonial First State, SuperSA and UniSuper.

Read the Report below.

Traditional owners in the NT reveal human rights responses – The Guardian, 13 July, 2023

Tiwi islanders accuses banks of human rights failure after concerns raised over Santos funding – The Australian, 13 July, 2023

Banks ‘failed human rights’ over Santos NT gas project – Yahoo, 13 July, 2023

Noongar-Yamatji Senator Dorinda Cox backs Traditional Owners in battle with banks, National Indigenous Times, 5 April, 2023

Traditional owners set sights on 12 banks in Barossa gas battle, ABC News, 5 April, 2023

Australia Indigenous group urges banks to halt Santos gas project funding, Reuters, 4 April, 2023

DBS among international banks to get human rights complaints over loan to gas company, The Straits Times, 4 April, 2023

Human rights case lodged over Tiwi Islands gas field, The Guardian, 4 April, 2023

Traditional owners ask banks to reconsider Santos loan, The New Daily, 4 April, 2023

Banks targeted in fresh Santos gas battle, Australian Financial Review, 4 April, 2023

Banks face Tiwi claim over Santos loans – The Australian, 4 April, 2023